You probably feel like a tiny fish in an ocean when you’re trading with a small account.

Because the profits you make seem so insignificant that you wonder if it’s worth your time and effort.

But here’s the good news…

In today’s post, you’ll discover 5 practical trading tips to help you grow your small trading account into 6-figures, or more (and trading strategies for small accounts).

The best part?

You’ll learn how to do it steadily so you don’t blow up another trading account—even if you have done it the last 5 times.

So let’s get started…

How to exploit the 9th wonder of the world and massively increase the size of your trading account

As you know, compound interest is the 8th wonder of the world.

Here’s how it works…

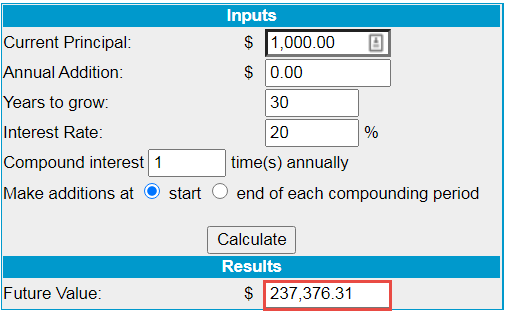

Let’s say you have a $1,000 trading account and you earn an average return of 20% a year.

After 30 years, your trading account would be worth…

$237,376.

Not bad.

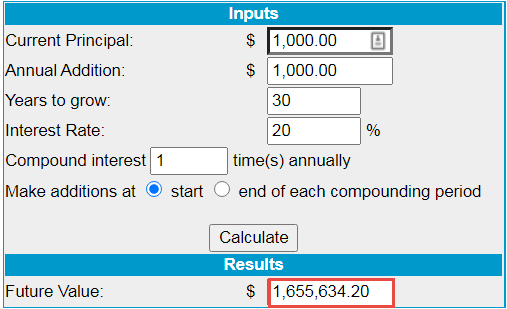

But, what if you add an extra $1,000 to your trading account each year, what difference would it make?

So, let’s do the math again…

Let’s say you have a $1,000 account, you earn an average of 20% a year, and you add another $1,000 to your account every year.

After 30 years, your account would be worth…

$1,655,634.

Holy cow!

Can you see how powerful this is?

Yes, compound interest works great. But, if you want to put it on steroids, then you must regularly add funds to your trading account—that’s how the big money is made!

So if you want to know how to grow a small account successfully, you must think in terms of how you can “grow” your trading business and not treat it like a job.

Why looking at your profits causes you to remain a loser

Here’s the thing:

Most of us get involved with trading because we want to make money.

However, when you have a small trading account, focusing on your profits will hurt your trading performance.

I’ll explain…

Let’s say you have a $500 account and you made a profit of $20 on a trade.

Then you’ll think to yourself:

“I invested so much time in trading just for a measly $20?!”

“I need to make more money to justify the effort I put into trading.”

So, you ignore risk management and place larger trades. You might get lucky and double the size of your account.

Eventually… lady luck runs out and you wipe out your entire trading account.

So here’s the lesson:

Don’t focus on the size of your profits because with a small trading account, your profit & loss will also be smaller.

Instead, one concept on how to grow small trading account is to look at it in terms of R (a concept I learned from Dr. Van Tharp).

This refers to your gain/loss relative to the risk you took on a trade.

For example:

- If you risk $10 on a trade and made back $50, that’s +5R (50/10)

- If you risk $1,000 on a trade and made $500, that’s +0.5R (500/1000)

- If you risk $200 on a trade and lost $300, that’s -1.5R (300/200)

So by focusing on your R multiple, you’ll have an objective view of your trading performance—and not get swayed but your “tiny” profits.

The secret to trading a 7-figure trading account (it’s not what you think)

Let me share a story with you:

I’ve been lifting weights since I was 20. And when you’re young, all you cared about was lifting heavier regardless of your form.

Eventually, I paid the price.

My poor form and heavy lifting got me an injured back.

Now, I knew that if I wanted to continue lifting, I need to re-learn how to lift weights—so I got a coach to help me with it.

And do you know what’s the first thing we did?

We stripped off all the weights and just focus on lifting an empty bar (no ego, no pride, nothing).

Then he taught me the process of how to do a proper squat:

- Approach the bar

- Keep your shoulders tight

- Lift the bar and take 2 steps back

- Keep your back straight and feet pointed out (about 45 degrees)

- Take a deep breath

- Squat and maintain posture

- Use your glutes and drive up to a standing position

Once I mastered the process, then we added weights to keep gaining strength.

And guess what?

Whether you’re lifting an empty bar or 100kg, the process of doing a proper squat is the same!

Now, why am I sharing this with you?

Because it’s the same for trading!

Whether you’re trading a $500 account or $1m account, the process is the same (the only difference is the number of zeros behind your trading account).

So keep that in mind on knowing how to grow small account in forex or in any other markets out there.

If you want to learn more what the trading process entails, then go read How To Be A Profitable Trader (Within The Next 180 Days).

Not all brokers are created equal. Here’s what you must look for when trading a small account…

Here’s the deal:

Whether you’re trading a $100 or a $1m account, one thing is constant—your risk management.

This means you want to keep your risk per trade to not more than 1% of your account.

For example:

- On a $100 account, your loss on a trade shouldn’t exceed $1.

- On a $10,000 account, your loss on a trade shouldn’t exceed $100.

- On a $1m account, your loss on a trade shouldn’t exceed $10,000.

Now if you have a $10,000 account (or more), then most forex brokers can meet your risk management needs.

But on a $100 account, you have further constraints because your loss cannot exceed $1.

Let’s say you trade 1 micro lot with a stop loss of 50 pips.

If you do the math, that’s a potential loss 5% to your account—not good.

The solution?

You must find a Forex broker that lets you trade nano lots (which are even smaller than micro lots).

These brokers are market makers and they will allow you to practice risk management even on a small trading account.

How to profit from your mistakes without paying expensive “tuition fees”

When you trade with a large account, your “tuition fees” to the markets will be costlier.

For example:

If you risk 1% on a $1m account, then your potential loss on the trade is $10,000.

So if you make a mistake, that would cost you $10,000.

On the other hand:

If you risk 1% on a $1000 account, then your potential loss is $10 which is a much lower “tuition fee”.

So, don’t fret if you have a small trading account because this is a great time to learn from your mistakes—while they are still “cheap”.

So now the question is…

How can you learn and even profit from your mistakes?

Here’s how…

- Journal down at least 100 trades (whether it’s trading breakout, pullback, etc.)

- Identify the setups that make you money and focus on trading these setups

- Identify the setups that cost you money and avoid these setups

And the best part is:

It won’t cost you much to find out which your money-making setups are and which to avoid at all cost.

So there you go, trading strategies for small accounts that you can consider using.

Conclusion

So here’s what you’ve learned:

- If you want to grow your small account into 6 or 7-figures, then you must regularly add funds to it

- Don’t be obsessed with your profits because it will make you depressed. Instead, focus on increasing your R-multiple

- The process of trading a small account is similar to a large account. So focus on the process, not the money (which comes later)

- Your trading mistakes will be “cheaper” on a small account. So learn and profit from it

- You must find the right broker which allows you to practice risk management even on a small trading account

Now here’s what I’d like to know…

How do you intend to grow your small trading account?

Leave a comment below and share your thoughts with me.

True words. Focus on the trade and the profit will come.

Hi Rhonda,

I’m glad to hear that!

Nice read. very informative

Hi Jared,

You are welcome!

Cheers.

Start small and focus on the R profits

Also keep a journal of 100 trades and keep a check on what works and what doesn’t – great advice

Hi Ros,

Keep it up!

Cheers.

That’s my motor start small and grow gradually

Awesome, take it slow one step at a time!

Start small and focus on the R.

Keep a check on what works and what doesn’t. The lower the tuition fee,the better way to learn.

Thanks for sharing, Bisiga!

Excellent rendering of the importance of risk management !!! which we small traders tend to ignore , trying to strike it rich and lucky!!!

Hey Radu,

Thanks for your contribution.

Cheers.

Like my $80 micro account, I would be targeting only 10-30 pips as the market to choppy now, even my risk to reward ratio is a 1 or 2 percent of my capital. So I will target small pips until I grow my account.

Thanks for sharing, Chisco!

Focus on the trades and the money will come, avoid taking high risk trades

Thank you for sharing!

I think it makes sense learning from this that either Big or Small account, Risk management is the guide answer. And focusing on the Process and not the profit. No wonder they say little drops makes an ocean.

Thanks Rayner.

You’re most welcome, Eliemman!

Hie

Thank you

if u don’t read and understand this article but will be one of people that are saying trading is a scam

Thumbs up

By using good risk management and not hurrying, because that is what I was doing

Thanks for sharing!

I fear not the man who practise 10.000 kicks one time but the man who practise one kick ten thousands time..I need Bruce Lee to remind myself..even I need wait for days or a week..is really a waiting game..and don’t squeeze trigger wrongly..

Nice share!

I love the way you educate me with news on forex trading. God bless you big

Anytime!

Trading small positions is cheap and effective trading education.

I couldn’t agree more.

What broker do you suggest I use to grow a $165 account, and what is s the percent risk for this account u suggest

Am willing to start small, but at the same time i need to focus on all aspects of my trading plan on how am i going to grow my account, because the challenge to us, sometimes we trade alone, without anyone helping, and thats the hard way.

Yes i would love to.

Finding a broker which allows me to practice risk management even on a small trading account.

Thanks Raynor – I think this has given me the extra push needed to journal trades properly (currently scribbling a quick note). New rule – no journal entry = no trade.

Gald to hear that Nick.

Best advice

Thanks

Excellent explanation to grow a small account., Useful for beginners like me , Thanks

Thank you, Govidaraj!

Loving the price action secrets book Rayner., slowly understanding .. thank you

Hi Peter,

You are most welcome!

Cheers.

YOUR ANALYSIS US OERFECT AND HELPFULL

Thank you, Kailash!

Hmm.. can’t seem to see any text recently on your website. Article is blank..

Hi Melvin,

It’s been fixed. Thank you for the feedback.

Hello! Can I get the copy of this book on PDF or in email

Hi Nwafor,

You can order the books through the link below.

https://www.tradingwithrayner.com/menu-books/

Your bonus covers your request.

Keep it up bro…reading all books and following you all the time.

Hi Suabira,

Thank you!

I was following all time. Just ordered two books

1. Price action

2. Pullback trading strategy

Very eager to read these books, I know how valuable you are.

Hi Tesfaldet,

I’m glad you did!

Cheers.

Its Very helpful,many thanks rayner

Thank you, Manfred!

Thanks for these simple steps. Would love to hear from you more.

You are welcome, Anant!

Hi rayner this is Roosevelt I’m interested in your book title thanks for the encouragement.

…by applying a proper risk to reward ratio (1:3+)

on every trade. Not to focus on the account ballance but the discipline, when it comes to strategy by not neglecting the basics of Price Action…….

Great piece of information…… It would surely help in growing my account

I’m glad to hear that. Orla!

Great advice. Thank you

Thank you, Pamela!

I wish I could pay you back for all your lesson, but I couldn’t. For adding knowledge and teaching people the right way to make money, God will always Bless You. Love you Sir. Rayner Teo

Thank you for appreciating, Jaji!

Hi Rayner, would you be able to give us an example on how to set up a risk management trade. I can see everyone is talking about it but I’m confused on how it actually works

make sance every word

Very sance make

I’m so glad to hear that, Filiz!

Lovely

Thank you, Eweko!

Blog is not visible

Thank you Rayner. It is a very informative sharing of your article. Great learning from you! God bless!

You are welcome, Eljohn!

Hi Rayner,

Thanks for this powerful and insightful Post. I trade a $100 account using 0.02 lot size. I’ve tried this 1% risk of my equity, but with that, trading seems to be very slow and boring. I give back to the market whatever profit I make. I raised my risk to 3% of my equity, still the same story. Now I exit my trades immediately it hits -3$ without allowing it to hit my stop loss. The reason being that I use a risk to Reward of 1:1.5, but most of the time it doesn’t get to my TP, instead I see a winning trade becomes loser. Please how can I handle this challenge?

Thanks Rayner, you always break it to the lowest

Glad to hear that, Ella!

Journalling is what i’ve been missing. Risk + reward simply explained, big thanks. Focus on the process not the money!

You are welcome, Peace!

I wish i could receive 1:1 assistance

Hi Nariah,

You would be fine.

Cheers.

Money Management, Discipline, and Perfect Planning will help you to grow your small Trading account.

Glad to hear that, Rohit!

How do I get started? Can a bankrupt invest?

Nice ideal focus on the pattern that profit u and avoid the pattern that make u lose money

Awesome, Prince!

Hello Mr. Teo How do you intend to grow your small trading account?

Hey Biruk,

The process of trading a small account is similar to a large account. So focus on the process, not the money (which comes later)

Always add funds to your small account.

Cheers.

Hi sir, am from Nigeria I do like to chat with you

Mainly to know if the ebook of the ultimate price action can be sent to my email and I pay for it

Since no shipping to Nigeria thanks

Hey Asifat,

You can get your copy through Amazon.

https://amzn.to/3tETAsm

Cheers.

Trade smaller for lower “tuition fees”.

Concentrate on MY entry, not someone else’s.

Find my own exit before I jump in.

Be true to risk management plan.

Hey Mr.P

That’s awesome!

Thanks for contributing.

Cheers.

Great Information! This will definitely help to grow a small trading account. But Getting obsessed with your profits because it will make you depressed. Instead, focus on increasing your R-multiple.

Growing a small trading account is very big deal for many investors and traders. This article has focused upon all the relevant information and data’s which will boost to grow an account. Also, the subtopics wise question analysis in this blog has almost cleared all my doubts which will help to grow an account.

Glad to hear that, Nehayeole!

Slow and steady.

Quite helpful I will do exactly as you recommend

Awesome, Edwin!

I have started following it now.. 2020 I blown up $3000 with out knowing anything jumped in market. I paid very high price as per my capacity. Sad but learning finally. I do follow you.

Glad you are not giving up, Tania!

As a beginner in trading, this information is very much important for me to grow my small stock portfolio of Kotak Stock Trader app. Thank You.

You are most welcome, Ramesh!

fucose on the process of the R multiple and the constantly add some decent amount of funds to your trading account then the large number rule will come to play.

your HomeBoy

01Kim’sFX

Focus on trading the right way, profits will come as an afterthought.

That is true, Ben!

I really learn something from you Mr. Rayner

It’s our pleasure!

Tnx Rayner.

Changing lives

You’re most welcome, Bobby!

Hi Rayner

Love this book I read and read over and over again always picking up something new thanks and well written

We’re glad that you loved it!

We hope it can help you in your trading journey.

Cheers!

After loosing 6digit money understood the lesson

Great speech now I truly understand risk management and would work towards what I’ve learnt here

Great, Iyanda!

We wish you good luck and good trading!

Cheers!

Hi Rayner,

This is powerful, I have been following you and you have helped a lot. I have started understanding forex and am now practicing from the dome because I have been blowing my account. Thanks regard Manson Musonda

Hey there, Manson

Jarin here from TradingwithRayner Support Team.

I highly recommend you practice first on a Demo account. and once you get a consistent positive results and the right strategy for you, you can hop on to live trading so you won’t shed money.

Hope that helps!

Hi Rayner,

First, I’d like to say you are a good teacher and I wish that I had known about you before I spent so much money trying to learn trading and sadly I still don’t know. My latest trade was when I saw price was under the 50, the 20 was also under the 50 and there was a bearish engulfing candle. I thought all was clear for a sell, but no, price went up. What do you think my mistake was? Thanks for any advice.

Sorry to hear that, Barbara.

Trading is all about probabilities and not guarantees. We can’t really predict where will the market go.

You can check this link about how to better your entries:

https://www.tradingwithrayner.com/how-to-better-time-your-entries-in-trending-markets/

Hope that helps!

Good work

Thanks, Patrick!

I’ve got my book from amazon, bought by my sister in NY, can’t wait to get hold of your book.

Hey there, Zaldy!

Jarin here from TradingwithRayner Support Team.

Thanks for purchasing Rayner’s book. I hope you enjoy reading it as I do.

Cheers!

I’ll find out a better profitable trading setup and add up 30% of monthly income to my account every month.

Wow!

Thank you for sharing your thoughts with us, Mohammed!

Cheers!

Very nice and informative.

Thank you Rayner.

You are most welcome, Chibuzo!

We are happy to help!

Cheers!

Focus on the ‘R’. Easy peasy. Think of R as R-ayner and his golden advice here. Thanks for the share R.

You got it right, Pharme!

You’re most welcome.

Cheers!

great learn the process money comes later

That’s right, David!

Thank you Rayner for the advice writing with a golden ink.

Rayner is very happy to help!

Cheers!

Will like to grow it by applying risk management when ever am trading, thanks rayner,am learning alot from you

Hey there, Maimuna!

Jarin here from Tradingwithrayner Support Team.

Yes, that is right! You may also find the links below useful regarding risk management:

https://www.tradingwithrayner.com/forex-risk-management/

https://www.tradingwithrayner.com/course/stock-risk-management-how-to-calculate-your-position-size/

Hope that helps!

We are very poor rayno,how I make money no job is there,I’m from India could you give us proven algo strategy….

Rayner does not do Algo Trading.

If you are looking for strategies, you might find the link below helpful:

https://www.tradingwithrayner.com/academy/trading-strategies/

Hope this helps!

Identify the setups that makes me money and focus on them.

Focus on the process, the money comes later

That’s very true, Favour!

Wishing you all the best.

Cheers!