Here’s the deal…

95% of traders don’t know what it takes to achieve trading success.

That’s why many traders have blown up their accounts.

That’s why would most traders go around in circles for years without results to show for.

That’s why only 5% of traders succeed in the long run.

So, what does it take to achieve trading success, someone who is consistently profitable in the long run?

Risk to reward ratio?

Trading psychology?

Discipline?

Nah, it’s more than that and it’s not what you think.

So, let’s break this down.

The first thing you need to know is…

Edge

An edge (otherwise known as expectancy) is something you do repeatedly that yields a positive outcome.

For example, you toss a coin:

- If it comes up head = you win $2.

- If it comes up tail = you lose $1.

In the long run, will you win or lose?

You’ll win. That’s because the size of your wins is larger than your losses. In other words, you have a positive edge (otherwise known as a positive expectancy).

Now what if it’s the opposite?

- If it comes up head = you win $1

- If it comes up tail = you lose $2

In the long run, will you win or lose?

You’ll lose. And you can see why. In this case, you have a negative edge (otherwise known as a negative expectancy).

Next, let’s go into more detail so you know whether your trading system has an edge, or not…

How to objectively define an edge

Mathematically, an edge can be defined as follows…

E= (Winning % x Average Gain) – (Losing % x Average Loss)

Don’t worry, this isn’t rocket science because even a 12-year-old can understand it.

Let me give you a few examples so you can see how this works…

Example 1: Positive edge (high winning rate)

- Winning Rate: 70%

- Average Gain: $80

- Losing Rate: 30%

- Average Loss: $100

E = (0.7 × 80) – (0.3 × 100) = $26

This means you can expect to earn an average of $26 per trade. So after 100 trades, you can expect to earn around $26 × 100 = $2600.

Another example…

Example 2: Positive edge (low winning rate)

- Winning Rate: 40%

- Average Gain: $200

- Losing Rate: 60%

- Average Loss: $100

E = (0.4 × 200) – (0.6 × 100) = $20

This means you can expect to make an average of $20 per trade.

And one last example…

Example 3: Negative edge (high winning rate)

- Winning Rate: 70%

- Average Gain: $10

- Losing Rate: 30%

- Average Loss: $100

E = (0.7 × 10) – (0.3 × 100) = -$23

This means you can expect to lose an average of $23 per trade.

Example 4: Negative edge (low winning rate)

- Winning Rate: 40%

- Average Gain: $120

- Losing Rate: 60%

- Average Loss: $100

E = (0.4 × 120) – (0.6 × 100) = -$12

As you can see…

You can have a high winning rate and still lose (example 3)

You can have a favourable risk-reward ratio and still lose (example 4).

So whenever you hear someone say…

“Profitable trading is about finding a minimum of a 1 to 2 risk-reward ratio.”

That’s nonsense because if your winning rate is too low, a 1 to 2 risk-reward ratio will not save you.

So here’s the deal:

On its own, your winning rate or risk-to-reward ratio is meaningless. You must combine both to know whether your trading system has an edge.

Now, having an edge alone will not make you a profitable trader. You also need…

Risk management

Risk management protects your downside no matter what happens (even if you have 10 losing trades in a row).

Without it, even a winning trading system will fail.

Here’s what I mean…

Imagine there are two traders, John and Sally.

- They have a $10,000 trading account

- They have a 50% winning rate

- They have an average of a 1 to 3 risk-reward ratio

- John risks $5000 per trade

- Sally risks $100 per trade

The outcome of the next 10 trades is as follows…

Lose Lose Lose Lose Lose Win Win Win Win Win

Here’s the result of both traders…

John blew up his account (after 2 losing trades in a row).

Sally made a profit of $1000 (calculation: -100 x 5 + 300 x 5 = $1000).

Do you see what I mean?

This is the importance of risk management because it protects your downside so you can let your edge play out in the long run.

But that’s not all because you also need…

Discipline

Discipline refers to following the rules of your trading system no matter what happens.

Even if you’re on a holiday.

Even if you don’t feel like it.

Even if you encountered 10 losses in a row.

That’s because you never know the outcome of each trade. By skipping trades, you are avoiding winning trades that could pay for the many small losses that you’ve incurred previously.

Let me give you an example…

Imagine the outcome of your next seven trades are as follows:

Lose Lose Lose Win Win Win Win

As you can see, by following your rules, you’ve encountered three losses in a row. On the fourth trading opportunity, you decide to skip the trade because you think it’s likely to be a loser.

So you skip the trade, and it turns out to be a winner.

Then, the fifth trading opportunity appears, but the pain from your recent losses is still raw, and you don’t want to live through it again. So you decide to skip the trade. And again, it turns out to be a winner.

Shortly, the sixth trading opportunity comes along. Now you feel stuck because you’re unsure whether to follow your system or skip the trade.

You wonder to yourself…

“Should I follow my rules?”

“But the recent wins must mean that losses are just around the corner.”

“This means the next trade is likely to be a loser.”

After much hesitation, you decided to skip the trade once again, and BOOM, another winner!

At this point, you feel disappointed with yourself for not following your rules and cherry-picking your trades based on how you feel, rather than what you know you should do.

So you promise yourself you’ll take the next trade when the opportunity arises.

Eventually, the seventh opportunity comes along and you follow your rules.

Finally, you caught a winner! But, you still lost money overall. That’s because your recent winner isn’t enough to cover your earlier losses.

However, if you had the discipline to follow your rules instead of trading based on how you feel, you would have been net profitable.

So here’s the deal…

Consistent action leads to consistent results. If you want to be a consistently profitable trader, then you must be consistent with your actions—and that means being a disciplined trader!

Now, you know what it takes to become a consistently profitable trader. But still…

Why do most traders fail and how to avoid it?

Here are 3 common reasons why traders fail…

- No risk management

- No edge

- No discipline

Let me explain why it happens and how you can avoid it…

No risk management

Most traders blow up their accounts because they don’t have risk management.

For some, they also don’t have discipline or have any idea what they are doing. So when you combine these factors, it’s a recipe for disaster. That’s how traders can blow up multiple trading accounts.

So, what’s the solution?

Risk management.

This concept is not difficult to learn and will pay dividends for the rest of your trading career.

If you want to learn risk management for stock trading, watch this training…

For forex traders, this is for you…

No edge

For this scenario, you’re familiar with risk management and can contain your losses. But still, the value of your trading account is depleting over time.

At this stage, you no longer blow up your account. However, you have many small losses, and when added together, it leads to a big hole in your account.

This is what I call death by a thousand cuts.

So, how can you overcome this?

Your trading system must have an edge in the markets, something you do repeatedly that yields a positive outcome.

Sounds familiar? It better be!

So if you want to learn proven trading systems that work, then this book is for you.

Next…

No discipline

For some, you know what to do as a trader.

You have risk management and an edge, but still, your results are inconsistent.

Why?

That’s because you lack discipline. Without discipline, your actions are inconsistent and thus, your results are inconsistent.

So, how can you become a more disciplined trader?

There are a few ways you can go about it, but one method I find particularly effective is…

To have an accountability partner.

This means you’ll have someone to check in on you regularly to make sure you follow your trading rules.

If you fail to do so, you’ll get a penalty (like paying a fine, buying your friend a meal, etc.).

As a human being, you have an ego and don’t like to look bad in front of others.

So by having an accountability partner, you’ll avoid looking bad by following the rules of your trading system.

Does it make sense?

Great!

So to sum up…

Trading Success = Edge + Risk Management + Discipline

There’s no two ways around it.

You can’t have one without the other.

You can’t have 1 or 2 factors—you must have all 3.

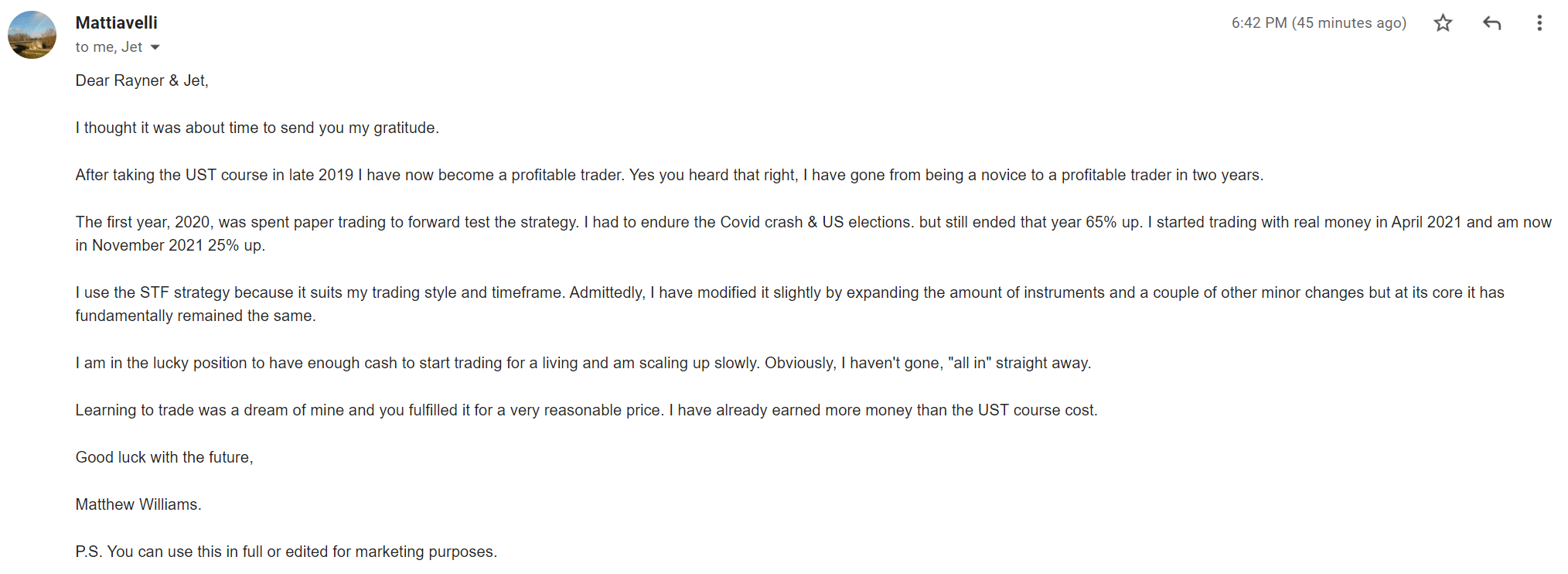

That’s how my student, Mattiavelli, who traded with a proven system, got results like this…

“The first year, 2020, was spent paper trading to forward test the strategy. I had to endure the Covid crash & US elections but still ended up 65% for the year.

I started trading with real money in April 2021 and am now up 25% for the year.”

Now you’re probably wondering…

“So which of the 3 should I work on first?”

Find an edge? Master risk management? Become a disciplined trader?

In my opinion, learn risk management first.

It’s the lowest-hanging fruit because you can learn it in under an hour and it’ll pay dividends for the rest of your trading career.

Next, work on finding an edge. This part will take the longest because most of the stuff doesn’t work. So, you’ll need to verify it either through backtesting or forward testing (which takes time and effort).

And lastly, discipline. I put this last because most discipline issues come from not having an edge or proper risk management.

For example…

- You have difficulty following the rules because you don’t know if your trading system really works or not (no edge)

- You can’t follow the rules of your trading system because you lost too much and need to make it all back on the next trade (no risk management)

However, once you have an edge and proper risk management, most of your discipline problems melt away.

Conclusion

Trading success is when you have an edge, proper risk management, and the discipline to follow your rules.

Most traders fail because they lack one of these in their trading. But when you have all three, you’ll become a consistently profitable trader.

The hardest part is finding an edge. That’s why I wrote the book, Trading Systems That Work, so you can shortcut your learning curve.

It comes with 3 proven trading systems that work so you can profit in a bull market, a bear market, and even during a recession.